The next summer intern application deadline is November 18th.

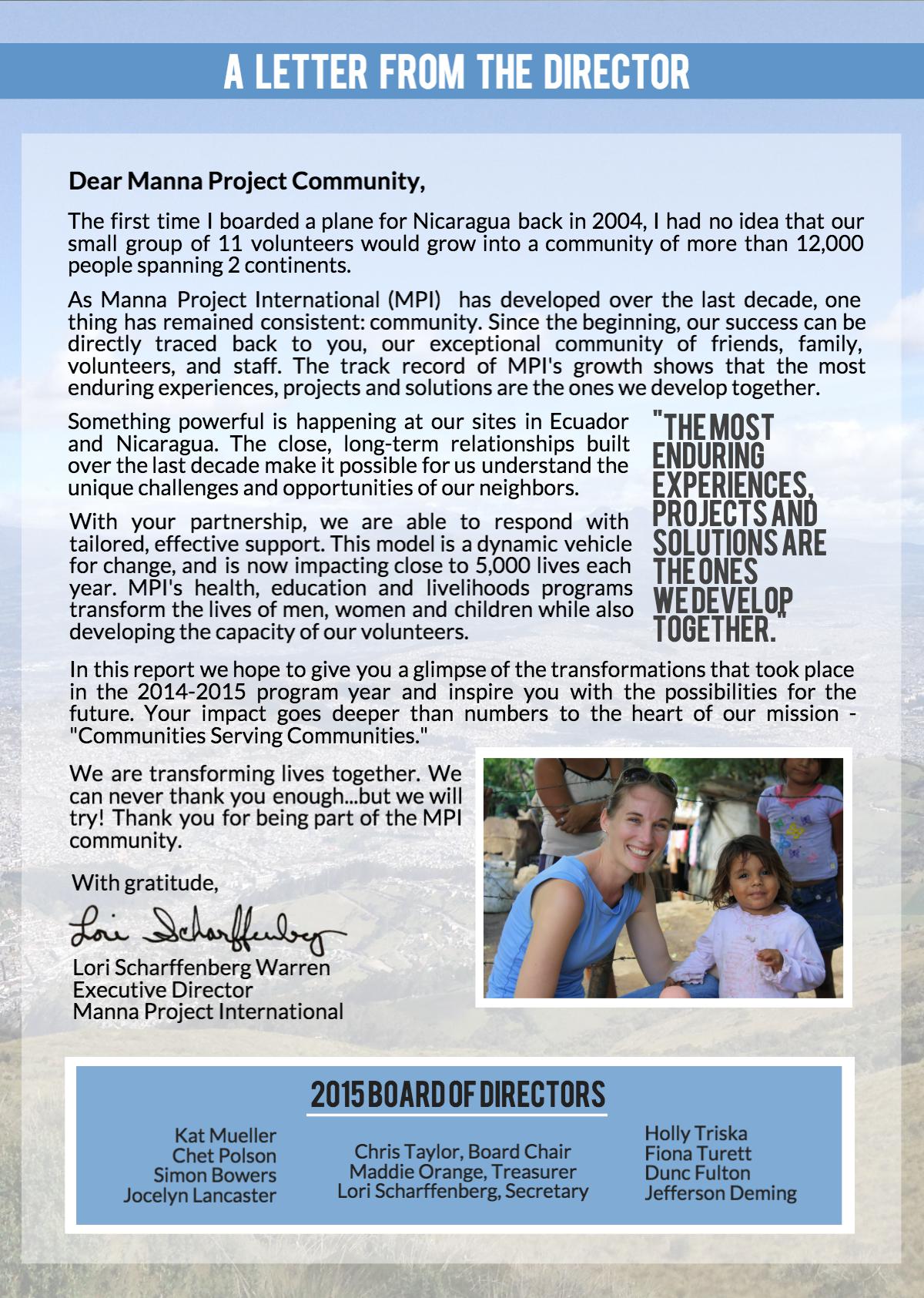

Summer Interns live alongside other young leaders and community members, and are fully integrated into the daily functions of Manna Project’s work on the ground. Weeks are spent collaborating with staff to plan and facilitate programs, while weekends are for exploring. As the days progress, you will develop an understanding of long-term development goals and their implementation.

This unique internship program is designed to create the most impactful experience for you and the communities you’ll serve. Summer Interns are equipped and inspired to continue their work in a variety of career fields, including international development and the greater non-profit sector. Many Summer Interns return to Manna Project as Program Directors in following years.

Summer 2017:

Session 1: May - June, 4 Weeks

Session 2: June - July, 4 Weeks

Both Sessions: May - July, 8 Weeks

Begin your journey here:

Looking for a more in-depth international development experience? MPI's Program Directors spend 5, 7 or 13 months on site.

Sign Up for More Info

“My time spent with Manna Project International has been one of the most rewarding experiences of my life. I developed incredible relationships and made memories that I will cherish forever. Part of me will always be involved.”

:

: